Bursa Malaysia news. KLSE Stock Market. Share Market. Stock Exchange. Market Watch. Stock price. Stock quote. Equity markets.

Friday 26 August 2011

Friday 19 August 2011

Bursa Malaysia: Dividends for Week 34 (22nd to 26th August 2011)

Friday 12 August 2011

Bursa Malaysia: Dividends for Week 33 (15th to 19th August 2011)

Tuesday 9 August 2011

Bursa Malaysia: Dividends for Week 32 (8th to 12th August 2011)

Friday 29 July 2011

Monday 18 July 2011

Friday 8 July 2011

Bursa Malaysia: Dividends for Week 28 (11th to 15th July 2011)

Friday 1 July 2011

Bursa Malaysia: Dividends for Week 27 (4th to 8th July 2011)

Sunday 26 June 2011

AGM Week 26: AMEDIA AGM and PERISAI AGM

- Date: 23 June 2011 (Thursday)

- Time: 9:00 a.m.

- Venue: Ivory 10 Room, Holiday Villa Hotel and Suites Subang

9, Jalan SS 12/1, 47500 Subang Jaya, Selangor Darul Ehsan, Malaysia

PERISAI PETROLEUM TEKNOLOGI BHD (PERISAI) AGM

- Date: 24 June 2011 (Friday)

- Time: 10:00 a.m.

- Venue: Mezzanine Floor, Hotel Equatorial

Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia

Friday 24 June 2011

Bursa Malaysia: Dividends for Week 26 (27th June to 1st July 2011)

Saturday 18 June 2011

Monday 13 June 2011

KLSE updates: XOX making gains

As at 10:50am today, the shares rises to RM0.535, up RM0.01 over yesterday's closing price.

Issued at RM0.80 (over-subscribed by 13.2 times), XOX debuted at RM0.73 (7 cents below RM0.80 issue price) and continued to slide ever since. It closes at RM0.52 on its first day of IPO (10th June 2011), which was a 35% discount ffrom its IPO price.

The company reported a net loss of RM1.67mil for the three-month period ended March 31, mainly due to the selling and distribution expenses necessary in creating brand awareness for XOX's services, it said in a note to Bursa Malaysia on Thursday (9th June 2011).

More related articles:

Friday 10 June 2011

Bursa Malaysia: Dividends for Week 24 (13th to 17th June 2011)

Friday 3 June 2011

Bursa Malaysia: Dividends for Week 23 (6th to 10th June 2011)

Friday 27 May 2011

Friday 20 May 2011

Sunday 15 May 2011

GENS-C8 and GENS-CC dived after 2011 Q1 Result

GENS-C8 and GENS-CC dived after briefly raise a few cents when Genting Singapore's 2011's 1st quarter result being announced. Instead of moving higher, the share had just upped RM0.005 as at of today, 16th May 2011.

The performance of Resort World Sentosa having a much better result than Marina Bay Sands (MBS) doesn't lift it's stock higher. With MBS sinking 10% after their announcement, maybe Genting Singapore should felt relieve to be able to stay above it's last price before announcement instead of diving.

As for KLSE888 portfolio, a dilemma sets in:

- Is GENS-C8 and GENS-CC a good pick

- What's KLSE888 portfolio's next step: sell now to avoid potential further loss and scout for a new replacement, OR hold it till it finds a new promising stock to swap to?

Friday 13 May 2011

Bursa Malaysia: Dividends for Week 20 (16th to 20th May 2011)

Thursday 12 May 2011

Genting Singapore Achieved Record Revenue for 2011 Q1

According to report released at 5:30pm, the group revenue for the first quarter of 2011 was S$922.6 million. Singapore IR experienced good win percentage and gaming volume in the first quarter of 2011 with steady growth in Universal Studio Singapore (“USS”) and the hotels. The daily average visitation to USS was about 7,400 with an average spending of S$88 per visitor. Singapore IR’s hotel occupancy was 79% with an average room rate of S$280. Group’s net profit in the first quarter of 2011 was S$305.4 million, where the following were significant drivers:

- Singapore IR delivered the highest quarterly adjusted EBITDA of S$537.9 million with margin of 59% at the back of strong revenue growth; offset by,

- Higher depreciation and amortisation of S$76.6 million in the first quarter of 2011 attributable to the full quarter effect of depreciation charges for 2011;

- Higher finance costs of S$39.7 million was mainly due to charges related to the refinanced syndicated loan facility; and

- Higher taxation of S$77.4 million in the first quarter of 2011 mainly from the higher deferred tax expenses due to temporary difference in property, plant & equipment.

Singapore IR recorded a stronger result for first quarter of 2011 compared to its competitor, Marina Bay Sands. EBITDA for Singapore IR was S$538 million, as compared to Marina Bay Sands' S$351.6 million for the same period.

Hopefully, GENS-C8 and GENS-CC will soar high up in the sky...!!

- GENS-C8 at RM0.23. GENS-CC at RM0.13. KLSE888 Portfolio 6% growth in 3 weeks.

- Sold MEGB (30% profit). KLSE888 portfolio @ RM6000 (20% profit).

- More about KLSE888 portfolio

Thursday 5 May 2011

Genting Singapore Q1 result out in 12 May 2011.

Recently, Genting Singapore's share fell after rival Las Vegas Sands missed analyst result target in their financial report, thus raising concerns about Genting Singapore's own result due out in the coming week.

As of today 5 May 2011, GENS-CC closed at RM0.10 and GENS-C8 closed at RM0.19. On KLSE888 portfolio, this downtrend had reversed the previous 3-week gain of 6%, thus making the portfolio having a -9% instead.

The question to ponder now is, will Genting Singapore suffers the fate of Marina Bay Sands, missing the analyst profit target?

Related articles:

0168 BOILERM debuts at RM0.825 (+0.495, +150%) in Bursa Malaysia (KLSE)

0168 BOILERM (Boilermech Holdings Berhad) debut in the ACE Market with a strong surge. IPO price at RM0.33, BOILERM opened at RM0.825, recording a 150% rise, hence becoming one of the best performer for 2011 IPO in KLSE.

BOILERM hit a high of RM0.995 which translate to a 200% gain for those who applied and get from the IPO. Even for those who bought in the early morning, they might have recorded a handsome 10% - 20% gain. But nevertheless, it's quite a gamble, especially when everywhere else is RED in the market.

The price closed at RM0.82. Can BOILERM maintain it's position at current stock weather?

Related articles:

- Boilermech Holdings Berhad Official Website

- 2011 KLSE Companies' IPO Performance

- Boilermech surges on KL listing debut ~ Btimes.com.my

Friday 29 April 2011

Week 18 Dividend Ex-Date: 2 - 6 May 2011

Thursday 28 April 2011

5197 FLBHD (Focus Lumber Berhad) surged 41% (25 cent) on debut

Focus Lumber Berhad (5197, FLBHD), a Sabah-based plywood, veneer and laminated veneer lumber manufacturer, garnered strong interest on the first day listing with 25 cent premium over its listing price of RM0.60.

It opened at RM0.85, and continue going uptrend before closing yesterday at RM1.18, which translated into almost 97% premium over its RM0.60 listing. For its shareholders whom had been holding it, imagine your holdings had doubled in 1 day!

Year 2011 seems to be a good year for IPO! Most of the companies whom debuted in 2011 had enjoyed a strong rally. FLBHD had joined them too. A total of 11 companies had listed in KLSE for 2011, with the next one (12th), Boilermech Holdings Berhad (BOILERM), debuting soon on 5th of May, 2011.

Related article:

Monday 25 April 2011

GENS-C8 at RM0.23. GENS-CC at RM0.13. KLSE888 Portfolio 6% growth in 3 weeks.

KLSE888 portfolio's growth have been on target since it's inception in March 2011. With RM5,000 capital, the portfolio had increased in size, with the latest total fund stands at around RM6600.

Currently, there are 2 stocks in this portfolio: GENS-C8 (bought at RM0.21) and GENS-CC (bought at RM0.12). Although there's a dip during the 2nd and 3rd week of April, this 2 stocks (call warrants) had managed a comeback. If KLSE888 had more funds, it shall definitely average down on those price dive!

At today's closing price, KLSE888 had managed to enjoy a paper gain of 6%. Hopefully, by the end of April 2011, it can hit a 10% gain as the portfolio outlined earlier this month as it dispose off MEGB to swap to these two counters.

Wednesday 20 April 2011

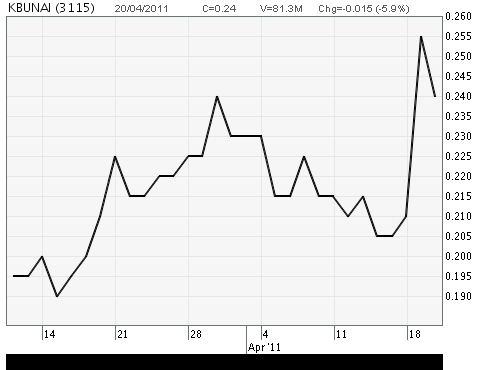

AMEDIA, TCUBES, SMARTAG & KBUNAI hottest stock today, thanks to ETP!

Today is an exciting day for those companies who get projects from Economic Transformation Plan (ETP). Since the announcement of ETP projects two days ago, these stocks had rise madly. Some of them even surged 800% !!

Below are the performance of the aboved mention companies for the last 1 month (watch out for TCUBES, 800% surge!!) :

AMEDIA:

TCUBES (current price: RM0.33) !!!!!

SMARTAG

KBUNAI

Related articles:

AMEDIA bulls as it receive ETP project

Asia Media will invest in developing the first Digital Live Transit-TV Broadcasting infrastructure in Malaysia. By adopting international broadcasting standard infrastructure, Asia Media is capable of delivering live video & voice into the transportation industry in the country.

Leveraging on its extensive Transit-TV network, which extends to over 3,000 Transit-TVs with Rapid K.L., Causeway Links and Konsortium Transnational Group, Asia Media is positioned to extend its Transit-TV network system into the LRT, Monorail and eventually the MRT. Asia Media also intends to venture its business model in foreign countries such as Singapore and Indonesia.

Investment: RM500 million by 2015

GNI Impact: RM604 million

Jobs Created: 400

Related articles:

TCUBES soars on ETP announcements

The MyEmail.my project which features the domain name of “myemail.my” is a private sector initiative led by Tricubes Berhad to provide a unique and official email account and user ID for interested citizens of Malaysia. It will serve as an alternative channel for 2-way communication between the government and rakyat. ‘Malaysian’ means created, operated and hosted in Malaysia.

The aspiration is for Malaysians aged 18 and above to be offered with a single secured communication channel to government e-services through a single user ID using the domain name “myemail.my”.

This user ID will eventually be used for any government e-services e.g. e-hasil, EPF statements, driving license renewals, quit rent payment etc.

Investment: RM50 million by 2020

GNI Impact: RM39 million up to 2015

Related articles:

Tuesday 19 April 2011

KBUNAI get a boost from ETP project

A consortium consisting of Prism Crystal Enterprises Ltd and Tan Sri Dr. Chen Lip Keong and group of companies together with the landowners, Karambunai Corp Bhd and Petaling Tin Berhad, will develop the Karambunai Integrated Resort City (KIRC) as a premier world-class ecotourism destination.

The KIRC will leverage on Malaysia’s competitive advantages in ecotourism and biodiversity, and feature tourism, health and eco-nature edutainment recreation facilities (e.g. water theme park, water spectacles and fountain, cable car, mangrove research centre, harbour cruise, aqua and spa village).

Investment: RM9.6 billion

GNI Impact: RM9.319 billion by 2020

Jobs Created: 11,002 by 2020

- More news on KBUNAI ~ klse888.blogspot.com, KLSE Stock Market Talk

- Companies whom benefits from ETP projects

Monday 18 April 2011

SMARTAG to benefits from Economic Transformation Programme (ETP) project

The Security and Trade Facilitation System entails the setting up of Radio Frequency Identification (RFID) infrastructure to provide security and Automation of paperless Royal Malaysian Customs Checkpoint throughout Malaysia.

Under this project, containers entering, leaving, and moving within the country will be tracked under the RFID system based on ISO18186:2010 and GS1 EPCglobal EPCIS standard. The reusable RFID Seal affixed to containers are scanned by RFID readers set up at locations to retrieve the container information. The RFID tags will be manufactured in accordance with standards set by the Malaysian Communications and Multimedia Commission (MCMC).

Amongst the advantages this system will afford are the improvement in efficiency of container clearance, which will reduce queeing times at Customs Check Points, the improvement of security through automatic detection of a compromised or open container, and the optimisation of human resources for better services.

Investment: RM45 million

GNI Impact: RM201 million by 2020

Jobs Created: 100

SMARTAG targets transborder customs clearance system for Malaysia, Thailand, Laos, Vietnam and southern China

After the recent implementation of the company's radio frequency identification (RFID) in Sadao and Suvarnabhumi Airport in Thailand, and the Mukdahan checkpoint at the border of Thailand and Laos (started on 1st of April, 2011), SMARTAG is looking to expand its system to Malaysia's neighbouring country, namely Thailand, Laos, Vietnam and southern China.

At the listing ceremony of SMARTAG, the company claimed that the advantage of this system is to speed up greatly on the transport time for land logistics across the above mentioned countries. Also present at the listing ceremony were SMARTAG chairman Datuk Abdul Hamed Sepawi, SMARTAG CEO PK Lim, Bursa Malaysia CEO Datuk Tajuddin Atan and Kenanga Investment Bank Bhd CEO Lee Kok Khee.

In 2010, SMARTAG recorded RM2.8 million of revenue, with 67% coming from Malaysia while 33% from its Indonesia operations. If SMARTAG successfully expand to Thailand, Laos, Vietnam and southern China, the company is on track to have a significant financial growth in the years ahead!

Related articles:

- Smartag aims to set up same system for transborder customs clearance ~ The Star

- Smartag makes smart debut ~ Business Times

- All articles related to SMARTAG ~ klse888.blogspot.com, KLSE Stock Market Talk

0169 SMARTAG surged on 1st day of listing

0169 SMARTAG debuts in KLSE with a 6.5 cents premium on 18th April, 2011. It has been the most actively traded share for the day, with 1,245,944 shares being traded (2.65x more than the 2nd most actively traded share, DBE) throughout the day. The share closed at RM0.38, having a 22.58% premium over the listing price of RM0.31.

Looks like all the IPOs for 2011 had stayed positive throughout the 1st trading day, which suggest that subscribing to IPO is an almost sure win bet.

Articles that might interest you:

- SMARTAG IPO oversubscribed by 268 times

- 2011 KLSE companies' IPO Performance:

5194 APFT (APFT Berhad),

0156 MPAY (Managepay System Berhad),

5196 BJFOOD (Berjaya Food Berhad),

5195 CENSOF (Century Software Holdings Berhad),

5192 KSSC (K. Seng Seng Corp. Berhad),

5191 TAMBUN (Tambun Indah Land Berhad),

5190 BENALEC (Benalec Holdings Berhad),

0159 AMEDIA (Asia Media Group Berhad),

5189 MAXWELL (Maxwell International Holdings Berhad) - Articles related to SMARTAG

Friday 15 April 2011

Week 16 Dividend Ex-Date: 18 - 22 April 2011

Wednesday 13 April 2011

2011 KLSE Companies' IPO Performance (updated 13 June 2011)

Listed on : 10 June 2011

Issued Price (RM) : 0.80

52-week Highest (RM) : 0.73 (10 June 2011)

5200 UOADEV (UOA DEVELOPMENT BHD)

Listed on : 8 June 2011

Issued Price (RM) : 2.90

52-week Highest (RM) : 2.62 (8 June 2011)

52-week Lowest (RM) : 2.43 (13 June 2011)

Issued Price (RM) : 0.2752-week Highest (RM) : 1.10 (18 May 2011)

52-week Lowest (RM) : 0.235 (13 June 2011)

Listed on : 10 May 2011

Issued Price (RM) : 0.5252-week Highest (RM) : 0.71 (10 May 2011)

52-week Lowest (RM) : 0.205 (13 June 2011)

Listed on : 5 May 2011

Issued Price (RM) : 0.3352-week Highest (RM) : 0.995 (5 May 2011)52-week Lowest (RM) : 0.565 (19 May 2011)

Listed on : 28 April 2011

Issued Price (RM) : 0.6052-week Highest (RM) : 1.40 (2 May 2011)52-week Lowest (RM) : 0.72 (7 June 2011)

Listed on : 18 April 2011

Issued Price (RM) : 0.3152-week Highest (RM) : 0.455 (21 April 2011)

5194 APFT (APFT Berhad)

Listed on : 18 March 2011

Issued Price (RM) : 0.50

52-week Highest (RM) : 1.10 (12 May 2011)

52-week Lowest (RM) : 0.525 (22 March 2011)

0156 MPAY (Managepay System Berhad)

Listed on : 15 March 2011

Issued Price (RM) : 0.16

52-week Highest (RM) : 0.335 (7 April 2011)

52-week Lowest (RM) : 0.155 (2 June 2011)

5196 BJFOOD (Berjaya Food Berhad)

Listed on : 8 March 2011

Issued Price (RM): 0.51

52-week Highest (RM) : 1.24 (6 April 2011)

52-week Lowest (RM) : 0.53 (8 March 2011)

5195 CENSOF (Century Software Holdings Berhad)

Listed on : 31 January 2011

Issued Price (RM): 0.9352-week Highest (RM) : 1.47 (6 April 2011)52-week Lowest (RM) : 0.69 (19 May 2011)

5192 KSSC (K. Seng Seng Corp. Berhad)

Listed on : 19 January 2011

Issued Price (RM): 0.57

52-week Highest (RM) : 0.685 (24 January 2011)

52-week Lowest (RM) : 0.51 (3 June 2011)

5191 TAMBUN (Tambun Indah Land Berhad)

Listed on : 18 January 2011

Issued Price (RM): 0.70

52-week Highest (RM) : 0.865 (18 January 2011)

52-week Lowest (RM) : 0.655 (15 March 2011)

5190 BENALEC (Benalec Holdings Berhad)

Listed on : 17 January 2011

Issued Price (RM): 1.00

52-week Highest (RM) : 1.61 (8 April 2011)

52-week Lowest (RM) : 1.19 (17 March 2011)

0159 AMEDIA (Asia Media Group Berhad)

Listed on : 11 January 2011

Issued Price (RM): 0.23

52-week Highest (RM) : 0.425 (11 January 2011)

52-week Lowest (RM) : 0.21 (10 March 2011)

5189 MAXWELL (Maxwell International Holdings Berhad)

Listed on : 6 January 2011

Issued Price (RM): 0.54

52-week Highest (RM) : 0.615 (10 January 2011)

52-week Lowest (RM) : 0.46 (6 May 2011)

Feel free to post this article in your blog/website if you find it useful. Please do so with a link back to this page, http://klse888.blogspot.com/2011/04/2011-klse-companies-ipo-performance.html. Thank you!

This article is about 2011 KLSE Companies' IPO performance : APFT IPO, MPAY IPO, BJFOOD IPO, CENSOF IPO, KSSC IPO, TAMBUN IPO, BENALEC IPO, AMEDIA IPO and MAXWELL IPO.

Monday 11 April 2011

12/4/2011: KLSE closed 1529.41 (-14.59, -0.94%) for morning session

Today KLSE opens 1,537.89 (-6.11) at 9am. Not a good sign. KLSE888 deeply suspect it is due to Sarawak election this Sunday.

KLSE went further down and closed 1,529.41 for the morning session, with maybe due to overall Asian market sentiments. Two Asian market that KLSE888 deeply followed:

- Nikkei 225 9,558.59 -161.11 (-1.66%)

- Hang Seng Index 23,980.07 -323.00 (-1.33%)

According to Tokyo (Reuter), Japan raised the severity of its nuclear disaster to the highest level on Tuesday, putting it on a par with the world's worst disaster nuclear accident at Chernobyl after another major aftershock rattled the quake-ravaged east (source: The Star). This is

Today is Invest Malaysia 2011. Looks like PM Najib's speech is not stimulating enough. If time permits, KLSE888 shall study PM's speech to see what went wrong.

MAA's deal with Zurich closing VERY soon?

MAA stands strong today, finishing in positive territory despite KLSE closing at 1544 (-13.49, -0.87%). Looks like the deal is going to be made anytime soon, as they had submitted an application to Bank Negara Malaysia (“BNM") on today, 11 April 2011, for the approval of the Minister of Finance pursuant to Section 67 of the Insurance Act 1996 of Malaysia to enter into an agreement with Zurich for the Proposed Disposal by the Company of their entire equity interest held in the capital of MAAB and the following subsidiary companies to Zurich :